Traditional startups focus on building new products or services from the ground up, whereas AI startups leverage artificial intelligence technology to provide innovative solutions.

AI Startups are the hot thing in the market right now, and all the VCs are looking to cash in big time. But nothing is to swear by, with 90% of AI startups failing within a year.

The massive increase in AI startups makes us wonder how fast technology advances. In this article, we share exciting yet serious data that gives insight into the risky world of AI startups.

Overview of AI Startup Statistics

| Metric | Statistic |

| Global VC Funding for AI Startups (2023 estimate) | $120-140 billion |

| US AI Startup Funding (2023 estimate) | $44 billion |

| China AI Startup Funding (2023 estimate) | $43.4 billion |

| Number of AI Unicorns (as of 2023) | 143 |

| AI Market Size (2028 estimate) | $1.07 trillion |

| Median Seed Funding for AI Startups | $2.5 million |

| Median Series A Funding for AI Startups | $15 million |

| Median Number of Employees at AI Startups | 62 |

| Most In-Demand AI Roles | Machine Learning Engineers, Data Scientists, AI Researchers |

| Leading Countries for AI Startups | US, China, UK, India, Israel |

Key AI Startup Funding Statistics

Global

| Category | Funding Estimate | Notes |

| Global Total | $120-140 billion [1] | VC funding for AI Startups |

| United States | $44 billion [2] | Leads in AI startup funding |

| China | $43.4 billion [3] | Second highest after the US |

| UK, India, Israel, Canada | $1-2 billion each | Key countries to watch [4] |

| Autonomous Driving | $5-7 billion [5] | As commercial services expand |

| Healthcare AI | $4-6 billion [6] | Growth in precision medicine |

| Enterprise AI | $7-10 billion [6] | Major opportunity |

| VC Firms Investing | 1,800+ [8][7] | Sequoia, Accel, Tiger Global lead |

| Median Seed Funding | $2.5 million [8] | – |

| Median Series A | $15 million [8] | For AI startups |

| AI Startup IPOs | 4-5 projected [10] | Could raise $25-40 billion |

Median

| Metric | 2023 Projection | Notes |

| Median VC deal size | $8.4M | Down from $10M in 2022 |

| Median AI startup funding | $14M | According to Crunchbase |

| Generative AI market size | $42.6B | According to Pitchbook |

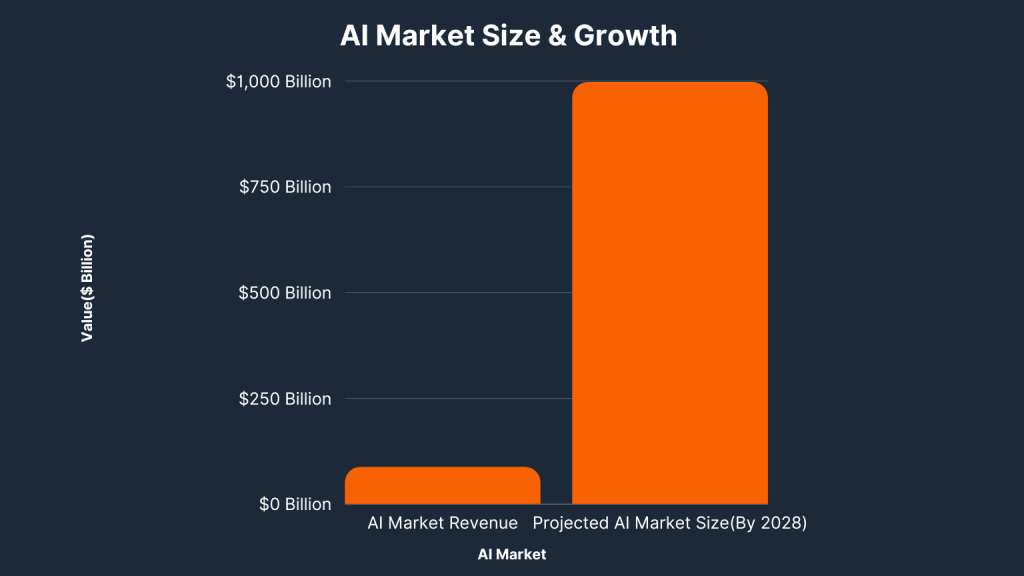

| Total AI market size | $1.07 trillion by 2028 | Per Grand View Research |

| Generative AI startups in India | 60+ | Across industry verticals |

| AI annual growth rate | 40.2% | 2021 to 2028 |

- As of 2023, there are 143 Artificial Intelligence Unicorn startups, according to data provided by CBInsights.

- As of April 2023, approximately half of the unicorns worldwide were headquartered in North America. The regions that hosted the fewest unicorns were Oceania and Africa, with 8 and 4 unicorns based in each area.

- In AI, these startups create innovative solutions and technologies that shape the future.

Most Well-Funded AI Startups

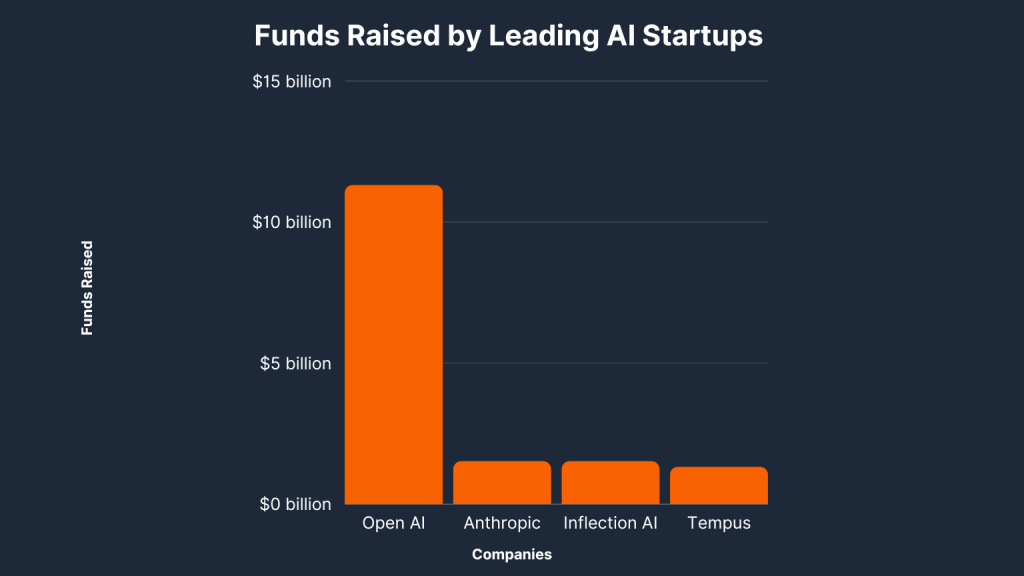

| Company | Valuation | Funds Raised | Year Founded | Focus Area |

| OpenAI | $29 billion | $11.3 billion | 2015 | Researching and developing ML solutions |

| Anthropic | $4.1 billion [12] | $1.5 billion | 2021 | AI safety and research |

| Inflection AI | $4 billion | $1.5 billion | 2022 | Human-computer interaction |

| Tempus | $8.1 million [12] | $1.3 billion | 2015 | Medicine solutions |

Demographics of AI Startups

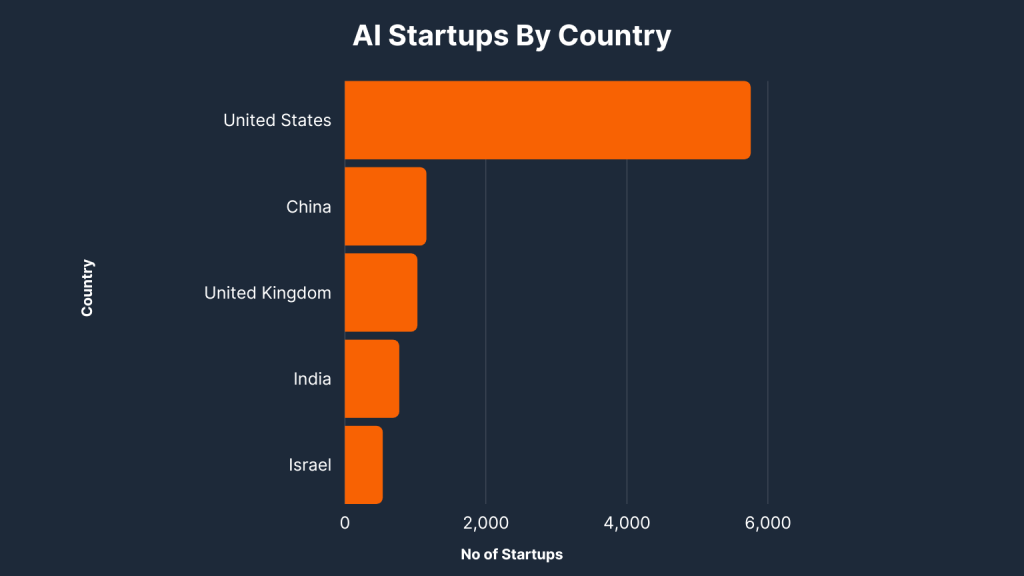

In 2023, the United States continues to lead in the total number of newly funded AI companies, with 1.9 times more than the European Union and the United Kingdom combined and 3.4 times more than China. However, China led the world in the number of generative AI startups receiving funding in the first half of 2023.

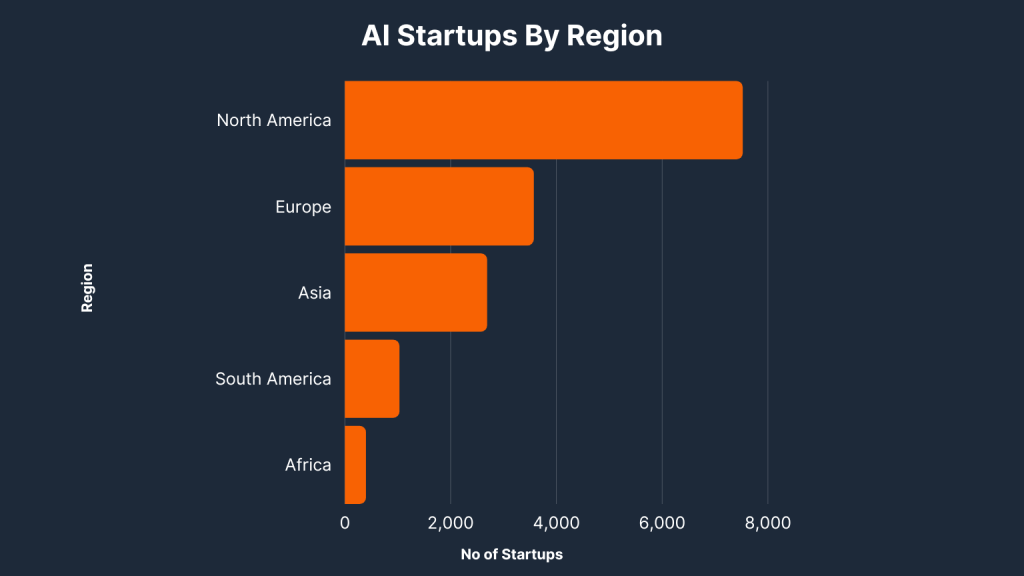

Number of AI startups by region

| Region | Number of Startups |

| North America | 7,522 |

| Europe | 3,569 |

| Asia | 2,686 |

| South America | 1,027 |

| Africa | 393 |

Number of AI startups by country

| Country | Number of Startups |

| United States | 5,749 |

| China | 1,152 |

| United Kingdom | 1,024 |

| India | 767 |

| Israel | 533 |

AI Market Size and Growth

| Topic | Year | Value ($ Billion) | Description |

| AI Market Revenue | 2022 | 86.9 | The estimated revenue of the AI market in the year 2022 |

| Projected AI Market Size | 2028 | 997 | The expected size of the AI market in the future |

| Technologies Fueling Growth | – | – | Machine learning, natural language processing, computer vision |

- AI is not just about robots and self-driving cars anymore. It’s permeating every industry, from healthcare to finance to entertainment. The AI market is no less than a futuristic playground, with a market size projected to reach $1.85 trillion by 2030.[9]

- Businesses worldwide recognize and invest heavily in AI’s potential. Global spending on AI systems is expected to reach $97 billion by 2023. [13]

- Investors are pouring money into AI startups like never before. In 2023 alone, AI startups raised over $40 billion in funding.

Generative AI Startups: Pioneers of Ingenuity

- Generative AI startups lead AI innovation, creating models that generate new content like music, art, or novels.

- These startups address significant AI challenges such as efficiency, accuracy, and fairness.

- The generative AI market size stands at $13.71 billion in 2023.

- The AI startup scene is vibrant, with new startups emerging regularly, each with a unique approach to using AI.

- The ecosystem supporting these startups includes investors providing funding, accelerators offering mentorship and resources, and communities providing support and inspiration.

- The global generative AI market is projected to reach $1.85 trillion by 2030, growing at a CAGR of 37.3% from 2023 to 2030. [9]

Key Application Sectors for AI Startups

| Top Sectors | Examples |

| Healthcare | Precision medicine, medical imaging |

| Finance | Fraud detection, risk modeling |

| Retail | Recommendation systems, inventory management |

| Autonomous Vehicles | Computer vision, predictive modeling |

- AI is transforming various sectors, including media and entertainment, where it’s used for tasks like visual dubbing.

- AI is being used for textile recycling in the fashion and retail industry.

- Many AI startups are focused on developing solutions that can be applied across various industries, such as AI assistants, human-machine interfaces (HMIs), digital twins, climate tech, and smell tech.

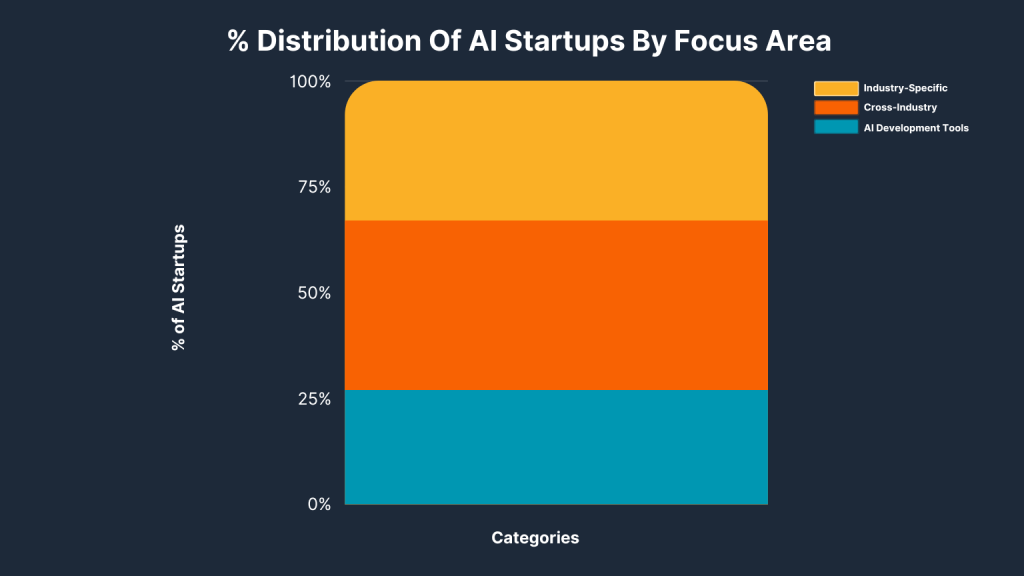

- Around one-third of the most promising AI companies in 2023 are focused on specific industries.

- Healthcare, finance, retail, and autonomous vehicles are hot sectors for promising new AI startups.

- A significant number of AI startups are also working on cross-industry solutions.

| Category | % of Startups | Details |

| Industry-Specific | 33% | Healthcare, finance, retail, autonomous vehicles |

| Cross-Industry | 40% | AI assistants, HMIs, digital twins, climate tech, smell tech |

| AI Development Tools | 27% | Vector databases, synthetic datasets |

- Around one-third of the top AI companies in 2023 focus on specific industries.

- About 40% are working on cross-industry solutions, including AI assistants and human-machine interfaces (HMIs), digital twins, climate tech, and smell tech.

- Approximately 27% of the companies are developing tools to support AI development, such as vector database tech and synthetic datasets.

AI Startup Growth: A Data-Driven Perspective

| Trend | Key Statistic | Source | Year |

| Market Growth | AI market to reach $407B Up from $86.9B revenue | ResearchAndMarkets

Statista | 2027

2022 |

| Corporate Demand | 64% believe AI will increase productivity | MIT Sloan Management Review | 2021 |

| Cloud Services | The global cloud AI market size is valued at $44.97 | Grand View Research [11] | 2022 |

- The AI market is projected to reach $407 billion by 2027, up from an estimated $86.9 billion in revenue in 2022.

- Corporations increasingly seek AI solutions. A significant 64% of businesses believe that artificial intelligence will help increase their productivity.

- This growing confidence in AI’s potential has led to an increase in acquisitions of AI startups.

- Cloud services like Microsoft Azure, Google Cloud, and Amazon Web Services are making powerful AI tools more accessible to companies of all sizes.

| Category | Details |

| Data | Expansion of datasets for model training |

| Algorithms | Development of sophisticated algorithms |

| Compute Power | Improvement in computing power |

| Corporate Demand | Increased acquisitions of AI startups |

| Cloud Services | Microsoft Azure, Google Cloud, AWS |

Talent and Computing Needs

| Metric | Statistic |

| Employees at prominent startup (OpenAI) | 500 |

| Most in-demand roles | Machine learning engineers, data scientists, AI researchers |

| Median employees at startups | 62 |

| AI talent demand | Growing significantly as more companies pursue AI |

| Salary competition | Startups struggle to match FAANG companies |

| Specialized hardware needs | TPUs for accelerating AI workloads |

| Hardware access challenges | TPUs are expensive/hard to access for startups |

- These startups are packed with talent; for instance, OpenAI, one of the most prominent AI startups in the world, has around 500 employees.

- AI startups stay agile with teams of around 62 employees, but as they grow, the demand for specialized AI talent increases significantly as more companies pursue AI solutions.

- AI startups seek scarce talents like machine learning engineers, data scientists, and AI researchers to build their innovations.

- When recruiting these professionals, they struggle to match the high salaries of big tech companies like Facebook, Amazon, Apple, Netflix, and Google (FAANG).

- As AI models grow more complex, startups need specialized hardware like Google’s TPUs to accelerate training, but acquiring these expensive chips remains difficult compared to the resources of large tech firms.

Struggles of AI Startups

- Finding experienced AI talent is extremely challenging.

- According to Gartner, demand for AI talent exceeded supply by 58% in 2022.

- We have to compete with big tech companies who can offer higher salaries and benefits.

- 31% of AI companies cite data management as their top challenge, per S&P Global.

- It is hard to predict customer needs due to the disruptive nature of AI.

- Dynamic technology makes maintaining a competitive advantage difficult.

- The complex value proposition takes time to communicate.

- AI Startups incur high computing infrastructure costs (CAPEX/OPEX).

- Requires expensive integration with existing systems.

- Ongoing monitoring and improvements add to costs.

Achieving Product-Market Fit for AI Startups

| Theme | Key Points | Examples |

| Identifying Problems | – Validate real customer problems – Focus on meaningful, urgent issues | – |

| Building Solutions | – Create competitive advantages – Requires technical and business skills | – ChatGPT: 10M users, $100M funding – Casetext: 5,000 customers, $50M funding – Zipline: 1M deliveries, $225M funding |

- Must identify and validate real customer problems through research and testing.

- Should focus on meaningful, urgent, and widespread issues.

- Examples like Grammarly (30M users, $200M funding) and UiPath (8,500 customers, $2B funding) have achieved product-market fit.

| Startup | Customers/Users | Funding | Product |

| Grammarly | 30 million | $200 million | Writing assistant |

| UiPath | 8,500 | $2 billion | Robotic process automation |

| ChatGPT | 10 million | $100 million | Conversational AI |

| Casetext | 5,000 | $50 million | Legal research |

| Zipline | 1 million deliveries | $225 million | Medical drone delivery |

Key Challenges Going Forward

| Challenge | Statistics | Source |

| Maintaining innovation | 85% of CEOs view innovation as vital 21% consider their firms innovative | Capgemini Research Institute |

| Managing expectations | 62% would trust the brand more with transparent, ethical AI use | Capgemini Research Institute |

| Regulations | 40% of US AI startups dealing with regulatory compliance | Brookings |

- A disquieting reveals that 85% of CEOs view innovation as vital. However, a measly 21% consider their firms innovative.

- Trust is a rare commodity in the age of data breaches. For AI, discretion is not just courageous but survival.

- According to Capgemini, 62% of customers would trust a brand more if it uses AI in a transparent and ethical way.

- AI’s regulatory landscape is like navigating a corn maze blindfolded. From GDPR to the CCPA, these are more than just acronyms but stumbling blocks. Regulatory compliance remains a complex challenge for AI startups.

- Brookings states that 40% of American AI startups are jumping through these regulatory hoops, making compliance a checkbox and a survival skill.

Conclusion

The AI startup landscape shows immense promise, but responsible growth requires overcoming ethical challenges, job loss, and responsible innovation. With prudent self-regulation and collaboration, AI pioneers can achieve great progress equitably. Realizing AI’s full potential demands cautious optimism grounded in wisdom.

References

- https://news.crunchbase.com/venture/vc-funding-falling-report-data-q2-2023-global/

- https://news.crunchbase.com/venture/vc-funding-falling-report-data-q2-2023-north-america/

- https://kpmg.com/cn/en/home/media/press-releases/2023/08/vc-investment-in-china-sees-growing-optimism.html#:~:text=VC%20fundraising%20in%20China%20during,to%20dispense%20to%20growing%20companies.

- https://news.crunchbase.com/venture/asia-funding-drops-china-india-israel-h1-2023/

- https://news.crunchbase.com/transportation/embark-trucks-closes-autonomous-vehicles/

- https://www.forbes.com/sites/petercohan/2023/05/30/generative-ai-7-trillion-ecosystem-invest-in-nvidia-microsoft-adobe-and-more/

- https://www.bloomberg.com/news/articles/2023-05-25/vc-giants-accel-sequoia-scour-portfolio-startups-for-ai-risk#xj4y7vzkg

- https://www.nasdaq.com/articles/ai-startup-hugging-face-valued-at-$4.5-bln-in-latest-round-of-funding

- https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-ai-market

- https://www.forbes.com/advisor/business/ai-statistics

- https://www.grandviewresearch.com/industry-analysis/cloud-ai-market-report

- https://www.insidermonkey.com/blog/5-best-funded-ai-startups-in-2023-1175183/

- https://www.globaldata.com/store/report/artificial-intelligence-market-analysis/